Financial Highlights

Board-Approved Limit (70%)

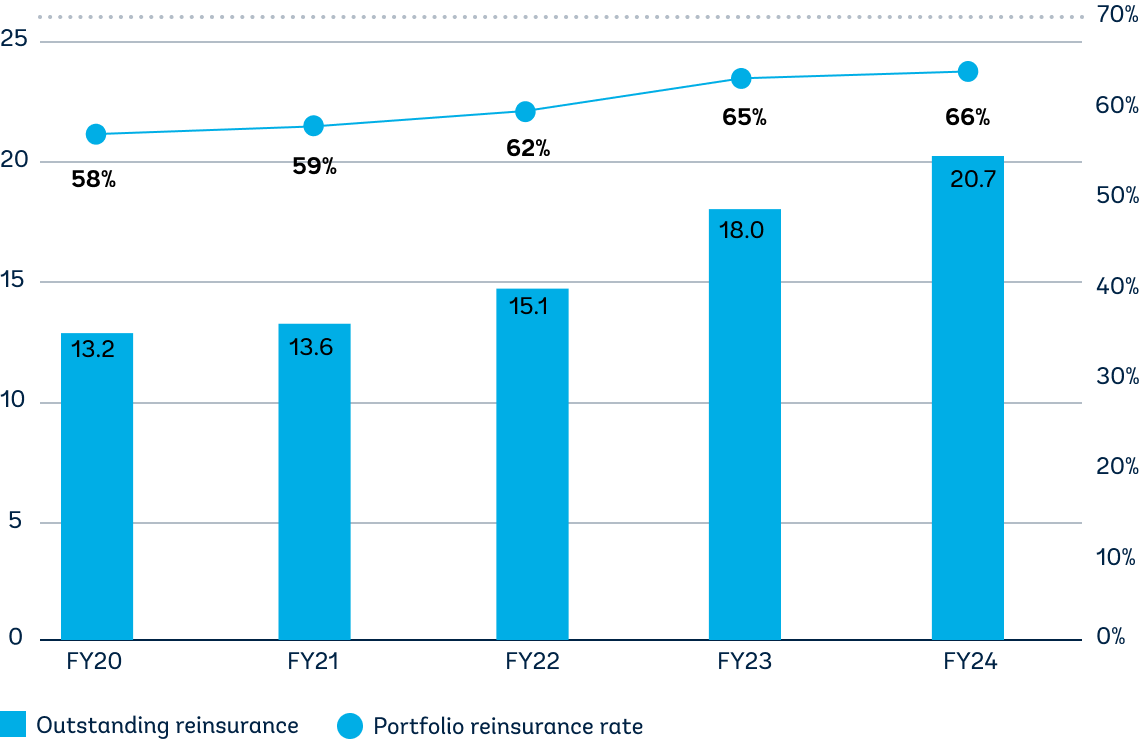

| By fiscal year (US$, millions) | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Gross premium income | 232.3 | 239.3 | 229.4 | 245.0 | 272.3 |

| Net premium income* | 117.1 | 121.3 | 116.3 | 123.9 | 130.5 |

| Administrative expenses** | 61.1 | 58.7 | 65.0 | 69.6 | 73.7 |

| Operating income*** | 56.0 | 62.6 | 51.2 | 54.3 | 56.9 |

| Net income | 57.2 | 81.5 | 27.7 | 139.4 | 179.5 |

| Administrative expenses to net premium income ratio | 52% | 48% | 56% | 56% | 57% |

| By fiscal year (US$, millions) | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Total economic capital* | 756 | 768 | 759 | 773 | 811 |

| Shareholders' equity | 1,335 | 1,474 | 1,539 | 1,706 | 1,892 |

| Operating capital** | 1,591 | 1,724 | 1,777 | 1,923 | 2,103 |

| Administrative expenses to net premium income ratio | 47.5% | 44.5% | 42.7% | 40.2% | 38.6% |

| Risk capital*** | 1,001 | 1,054 | 1,083 | 1,092 | 1,140 |

| Risk capital/operating capital | 62.9% | 61.1% | 61.0% | 56.8% | 54.2% |